what to look for when buying secondary cds

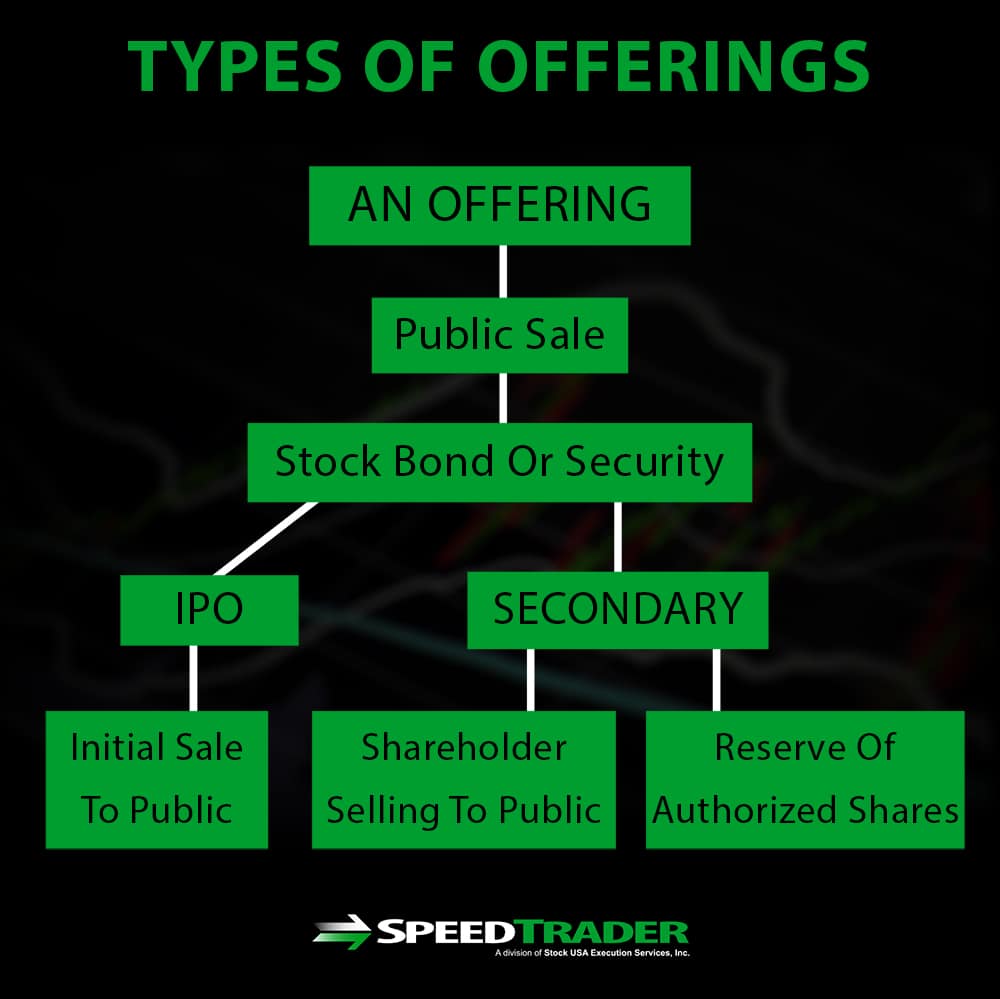

An offering occurs when a company makes a public sale of stocks, bonds, or another security. While the term offering is typically used in reference to initial public offerings (IPOs), companies can too make secondary offerings after their IPOs in order to raise boosted upper-case letter. In general, secondary offerings are made to the public to raise money for acquisitions and corporate growth, although they tin also be used to counter short-term cash-flow issues. Secondary offerings are of import to traders because they can dramatically affect the toll of a stock and present significant risks.

What is a Secondary Offering?

A secondary offering is whatsoever public sale of stocks, bonds, or another security that occurs subsequently a company's' IPO. Typically, secondary offerings involve a company making some of its reserve of authorized shares available for sale to the public, in which example all funds raised get to the visitor. Alternatively, a secondary offering may involve major shareholders, such as a founder, CEO, or institutional investors, selling their shares to the public. In this instance, coin raised from the sale goes to the original shareholders. In many cases, secondary offerings involve the sale of shares from both the visitor and from major shareholders at the aforementioned time.

Why exercise Companies Make Secondary Offerings?

Secondary off erings are ane of the nearly powerful tools that publicly traded companies and major investors have to raise money quickly. By selling shares that were previously held in reserve by the company'south treasury, companies tin can recei ve millions of dollars or more from public investors. This money can then be used to fund expansion projects, such as acquisitions or building corporate infrastructure in a new marketplace. Alternatively, the funds from secondary offerings can be used to provide a rapid cash infusion in the confront of liquidity issues, although ownership shares during such a secondary offering is often highly risky. For individual shareholders, participating in a secondary offer tin exist a way to cash out on their investment or to receive greenbacks for large personal purchases.

How practise Companies File Secondary Offerings?

Secondary offerings must be filed with the SEC, which ways that it'southward relatively straightforward for investors to find out near them. Secondary offerings can be searched using the SEC's EDGAR database , and the NASDAQ keeps an updated listing of secondary offerings past companies trading on that commutation. Often, secondary offerings are also highlighted in stock news feeds through company press releases and offerings by major companies will receive significant financial news coverage.

What Traders Should Be Aware Of

Dilutive vs. Non-dilutive Offerings

The single most important thing to understand about any secondary offering is whether it is dilutive or not-dilutive – that is, whether the offering will add to the total number of stock available to the public. Secondary offerings that involve the company selling stock that had previously been held in reserve – likewise known every bit follow-on offerings – are generally dilutive since they increase the amount of stock that is held by the public. Secondary offerings that involve major shareholders selling their stock are typically non-dilutive since this stock had already been held and is just changing hands among investors. In this case, the company has not increased the amount of stock that is held by investors.

Distinguishing between dilutive and non-dilutive offerings is important because dilutive offerings frequently lower the share value of shares that had already been held by the public. Equally a company releases more stock to the public, the portion of the company that each outstanding stock represents is diluted. Thus, investors who purchased stock during an IPO will own fractionally less of the company post-obit a dilutive secondary offering.

For this reason, secondary offerings are often a major cherry-red flag for existing investors. Oft, stock prices will refuse as soon as a dilutive secondary offering is announced to business relationship for the presently-to-be lower inherent value of each outstanding share.

In a non-dilutive offering, this is not the case. Since shares are only changing easily and no new shares are made bachelor, the proportional value of a single publicly held share does not change.

Offer Toll and Size

In a not-dilutive offering in which shares are offered at current market value, at that place should theoretically be no effect on stock price. However, in a dilutive offering, the share price that a secondary offering is fabricated at has a meaning effect on the price of existing shares.

The least disruptive scenario is when a company offers the new shares at a value that accounts for the electric current market value minus a disbelieve for the expected dilution effect. Nonetheless, if a company offers shares at a further discount, it can sharply drive down the toll of a stock as buyers will reject to pay more than than the price of the secondary offer until after the offering is made. Even afterward the offering is executed, the price of the stock will be lower than dilution tin can account for since traders who bought during the offer tin can sell at below the pre-offering market place price and all the same make a profit.

The size of the offering – that is, the number of shares being offered – amplifies these furnishings. If the offering is pocket-size relative to the number of outstanding shares, the dilution and the outcome of discounted pricing will similarly be pocket-sized. On the other hand, if the offering is large, the cost dilution effect will be pregnant and any disbelieve in the offer cost can have a meaning effect on market place value.

Offering Restrictions

While nearly secondary offerings do not come up with restrictions, it is important for investors to verify whether any restrictions be around a secondary offering. For instance, a secondary offering could carry a lock-up period, during which fourth dimension purchased shares cannot be sold, similar to those that typically follow an IPO.

Timing

Traders should be cautious when trading around secondary offerings, which means it is important for short- and medium-term traders to anticipate when a secondary offering might be announced.

The nearly common time for secondary offerings is immediately afterward the end of the l ock-up menstruation following an IPO. At this time, many insiders will sell shares in a not-dilutive secondary offering. Secondary offerings are also common when a visitor with a history of underperformance sees a price breakout on high book. In this case, the visitor may make a dilutive offer to raise money or major shareholders may make an offering to reduce their holdings in the company. Beyond these occasions, the best way to predict secondary offerings is to check on a company's track record of making secondary offerings and to understand the conditions around those offerings.

Conclusion

Secondary offerings can be a risk for companies and major shareholders to cash out of their investments, but they can stand for a significant risk for individual traders. Non-dilutive secondary offerings may theoretically non impact stock toll, they tin notwithstanding sour investor sentiment on a stock and drive prices down. Meanwhile, dilutive secondary offerings about e'er drive down the toll of a stock because they decrease the value of each individual share.

Traders should be wary of secondary offerings and the risks they pose. When possible, predict when a company will brand a secondary offering and avoid ownership stock ahead of these periods.

Source: https://speedtrader.com/understanding-secondary-offerings/